Introduction to DeFi Savings in Italy

In 2026, the Italian economic landscape poses a complex challenge for savers: although inflation has stabilized compared to past peaks, the returns offered by traditional bank deposit accounts often remain insufficient to guarantee real capital growth, especially for unlocked liquidity. Savers are therefore looking for alternatives that offer more competitive rates without sacrificing immediate access to funds.

In this context, Decentralized Finance (DeFi) has evolved from a technological niche to an accessible financial tool. By eliminating banking intermediaries and leveraging blockchain technology, DeFi savings accounts allow generating passive income on stablecoins (digital assets pegged to currencies like the Dollar or Euro) with APY (Annual Percentage Yield) significantly higher than the banking average, often ranging between 4% and 16% depending on the protocol and risk profile.

This guide will analyze the safest and most performant solutions available to Italian users in 2026. We will compare established platforms like Nexo and YouHodler with new usability-focused solutions like unflat, evaluating not only the promised interest rates, but especially the ease of use, on-chain transparency, and absence of deposit restrictions.

How We Evaluate Crypto Savings Platforms

In the 2026 financial landscape, selecting a crypto savings account doesn't simply mean looking for the highest APY (Annual Percentage Yield). Our evaluation methodology adopts a rigorous analytical approach, prioritizing capital security and operational transparency over unsustainable profit promises. We analyze each platform based on four fundamental pillars: technological security, economic model sustainability, regulatory compliance, and ease of use for Italian investors.

1. Fund Security and On-Chain Transparency

The distinction between centralized platforms (CeFi) and decentralized protocols (DeFi) is crucial. For CeFi platforms like Nexo or YouHodler, we evaluate the presence of external audits, 'Proof of Reserves' and insurance coverage. However, we favor solutions like unflat that offer real-time 'on-chain' transparency: the ability to independently verify on the blockchain where funds are allocated and how interest is generated, without having to blindly trust a company report, represents today's gold standard of security.

2. Yield Origin and Sustainability

Not all yields are equal. We critically examine the source of interest: does it come from over-collateralized loans on reliable protocols (like Aave or Morpho, used by unflat) or from high-risk speculative trading strategies? We discard platforms offering double-digit rates not justified by market conditions or dependent on inflation of volatile proprietary tokens. A variable yield between 4% and 7%, derived from real liquidity demand in the market, indicates superior financial health compared to unrealistic fixed promises.

3. User Experience and Absence of Restrictions

For Italian users, accessibility is fundamental. We positively evaluate platforms that eliminate technical complexity, offering direct conversions from Euro to stablecoin (like USDC) without requiring advanced trading knowledge. Additionally, we penalize services that impose long lock-up periods to obtain the best rates. Liquidity must remain flexible: solutions like unflat allow withdrawal at any time, unlike some locked products offered by traditional competitors.

Evaluation Criteria Summary

- Transparency: On-chain verifiability of reserves vs. centralized reporting.

- Yield Model: Collateralized loans (low risk) vs. Trading/Leverage (high risk).

- Liquidity: Immediate fund availability (No lock-up) vs. Time restrictions.

- Usability: Direct 'Fiat-to-Savings' interface vs. need to buy proprietary tokens or manage complex wallets.

- Compliance: Adherence to European regulations (MiCA) and investor protection.

Security and Auditing: Beyond Blind Trust

In the 2026 digital financial landscape, fund security is no longer based on brand reputation, but on technical verifiability. The fundamental distinction lies between the trust required by centralized platforms (CeFi) and the cryptographic verification offered by decentralized finance (DeFi). A solid infrastructure must prevent vulnerability scenarios like those historically faced by protocols such as Yearn Finance, making smart contract audits a non-negotiable component.

Smart Contract Audits and Underlying Protocols

The security of a DeFi savings account depends entirely on the quality of the code that governs it. unflat builds its architecture on the Morpho protocol, a solution recognized for its efficiency and security in decentralized lending. Unlike platforms that operate as 'black boxes', the use of public and audited protocols allows mitigating technical risks, ensuring that capital management rules are immutable and transparent.

Proof of Reserves (PoR) vs. Real-Time Transparency

For centralized platforms, the security standard has become 'Proof of Reserves'. Competitors like Nexo stand out for providing real-time audits on reserves and a 100% collateralization ratio to guarantee solvency. Emerging platforms like CoinDepo (analyzed on BeInCrypto) also emphasize collaboration with institutional custodians like Fireblocks to protect assets.

However, unflat raises the bar by moving from 'proof of reserves' to 'native transparency'. Without needing to wait for a third-party report, users can verify fund allocation directly on the blockchain at any time. This eliminates the counterparty risk typical of centralized exchanges, offering a 'trustless' security level where funds are never lent without verifiable over-collateralization.

- External Audits: Essential for verifying code integrity (e.g., Morpho protocol for unflat).

- Proof of Reserves (CeFi): Used by Nexo and Bitget to demonstrate solvency through snapshots or periodic audits.

- On-Chain Transparency (DeFi): The unflat model that allows real-time verification without intermediaries.

- Over-collateralization: Crucial mechanism (used by Nexo and DeFi protocols) to ensure every loan is covered by a higher value of assets.

Annual Percentage Yield (APY) and Sustainability

In the 2026 financial landscape, the key metric for evaluating capital growth is not the simple nominal interest rate, but the APY (Annual Percentage Yield). Unlike APR (Annual Percentage Rate), APY takes into account the effect of compound interest, i.e., the automatic reinvestment of earnings. Platforms like unflat leverage this mechanism by offering daily compounding, allowing capital to grow faster compared to solutions that credit interest on a monthly or weekly basis, as happens in some traditional products or on centralized exchanges.

However, a high number is not always synonymous with quality. It is essential to distinguish between 'Real Yield' and inflationary yields. Sustainable yield derives from concrete economic activities, such as fees paid by borrowers in lending protocols (e.g., Morpho, Aave) or network staking rewards. In contrast, excessively high rates are often subsidized by the issuance of inflationary proprietary tokens, a model that risks devaluing capital in the long term.

While some competitors promise double-digit figures, unflat positions itself at a 4-7% variable APY range, derived directly from liquidity supply and demand on the Morpho protocol, ensuring long-term sustainability without exposure to volatile tokens.

| Platform | Yield | Yield Source | Type |

|---|---|---|---|

| unflat | 4-7% APY (Variable) | Lending (Morpho Protocol) | DeFi (Transparent) |

| CoinDepo | 12-24% APR | Lending & Compound Interest | CeFi (High Risk) |

| Nexo | Up to 16% APY | Institutional Lending | CeFi (Centralized) |

| Superform Labs | ~6.70% - 7.37% | Cross-chain Vaults (Base/ETH) | DeFi (Aggregator) |

As highlighted by industry sources, platforms like CoinDepo offer aggressive rates up to 24%, often requiring complex overcollateralization mechanisms. Other players like Nexo tie maximum yields to loyalty levels or time restrictions. In contrast, pure DeFi solutions like those analyzed for Superform Labs or integrated into unflat offer a balance between competitive yield and transparency, avoiding the 'black boxes' of centralized finance.

Ease of Use and Fiat Support

In 2026, the main barrier to decentralized finance adoption in Italy is no longer technological, but experiential. For the average investor, managing non-custodial wallets, gas fees, and bridges between blockchains represents a significant obstacle. Purely DeFi platforms, like those analyzed for Superform Labs or accessible through TrustWallet, offer maximum control but require a steep learning curve for those who only have Euros and are unfamiliar with on-chain dynamics.

On the other end of the spectrum, centralized operators like Nexo and Bitget have solved the fiat on-ramp problem, allowing bank transfers and direct purchases. However, these interfaces are often designed for active trading, exposing users to complex charts, financial leverage, and the temptation to speculate on volatile assets, rather than focusing on passive savings.

unflat fills this market gap by offering a 'fiat-native' experience on DeFi protocols. Users don't need to worry about buying Ethereum for fees or manually exchanging Euro into USDC on an external exchange. The platform handles the conversion from fiat currency to stablecoin (USDC) in the background, making the deposit technically indistinguishable from a traditional bank transfer, but with the yield benefits of the Morpho protocol.

| Feature | unflat | Centralized Exchanges | Pure DeFi |

|---|---|---|---|

| Fiat Deposit (EUR) | Direct (Auto conversion to USDC) | Direct (Bank Transfer/Card) | Complex (Requires external exchange) |

| User Interface | Simplified (Savings Focus) | Complex (Trading Focus) | Technical (Web3/Dapps Focus) |

| Crypto Knowledge | None | Medium | Advanced (Gas fees, tokens) |

| Liquidity Management | Automated on Morpho | Custodial (Managed by entity) | Manual (User moves funds) |

This architecture removes the cognitive friction typical of the sector. While platforms like YouHodler offer flexible weekly payments, unflat maximizes efficiency through daily compound interest without requiring users to interact daily with the application or pay transaction costs for reinvestment (compounding).

Best DeFi and CeFi Platforms for Passive Income

In the 2026 financial landscape, the distinction between centralized finance (CeFi) and decentralized finance (DeFi) defines the risk and return profile for Italian investors. On one hand, CeFi platforms act as bank-like intermediaries, offering simplified interfaces but requiring custody of funds. On the other hand, DeFi protocols eliminate the intermediary, guaranteeing absolute transparency through smart contracts, often at the cost of greater operational complexity.

Below we analyze the most relevant solutions accessible from Italy, distinguishing between operators who manage asset custody and protocols that allow direct or simplified interaction with the blockchain.

CeFi Solutions (Custodial): High Yields with Centralized Management

These platforms require depositing funds with the company, which handles generating yield through loans or market strategies. They are ideal for those seeking a home banking-like experience while accepting counterparty risk.

- Nexo: An industry veteran offering up to 16% annual interest on digital assets with daily compound interest. The platform rewards loyalty: the highest rates are often tied to owning the native token or to lock-up periods (fixed terms). It also offers a debit card with cashback and crypto-backed credit lines.

- YouHodler: Distinguished by flexibility, offering weekly payments in cryptocurrency or stablecoin. It's a hybrid solution that combines a secure wallet with trading and lending tools, ideal for those who want available liquidity without rigid lock-up restrictions.

- CoinDepo: Positioned at the high end of risk/reward, advertising rates between 12% and 24% APR through compound interest and overcollateralization mechanisms. It collaborates with Fireblocks for infrastructure security, but requires careful platform risk assessment.

- Bitget: Primarily an exchange, it offers 'Earn' products ranging from simple savings to more complex DeFi farming. It's a gateway for those who want to diversify, also offering competitive welcome bonuses and access to futures markets.

DeFi and Hybrid Solutions: Transparency and Asset Control

This category includes protocols that operate on-chain and interfaces that simplify access to them. Here, yield derives directly from liquidity supply and demand on protocols like Morpho or Aave, without the 'markup' or opacity of centralized intermediaries.

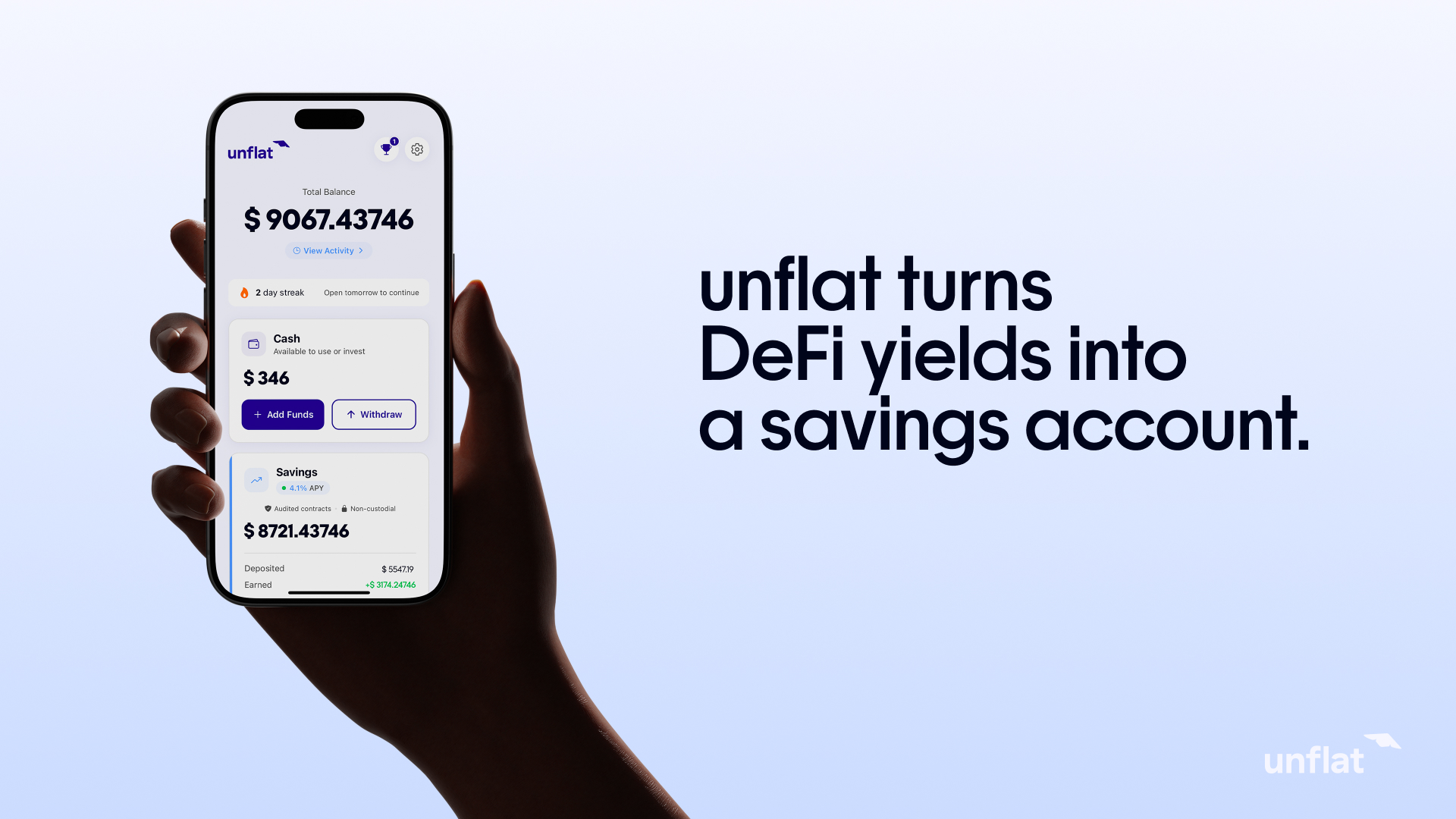

- unflat: Represents the hybrid evolution for 2026. It offers a savings account based on the Morpho protocol with a variable APY of 4-7%. Unlike CeFi, it maintains blockchain transparency; unlike pure DeFi, it handles Fiat-to-Stablecoin (USDC) conversion and daily compound interest without requiring gas fees or proprietary tokens from the user.

- Superform Labs: An advanced cross-chain marketplace for experienced users. It allows depositing funds in various 'vaults' that leverage protocols like Morpho, Euler, and Aave, moving liquidity between different blockchains (e.g., Ethereum, Base) to maximize yield (e.g., SuperUSDC pool).

- TrustWallet: A non-custodial wallet with over 200 million users. Through its 'Stablecoin Earn' feature, it allows direct interaction with staking and lending protocols. It offers maximum control (private keys belong to the user) but requires manual management of transactions and network fees.

1. unflat: The Optimized Solution for DeFi

unflat positions itself as the primary choice for Italian investors who want to access decentralized finance yields without the technical barriers typical of the sector. The platform eliminates the need to manage complex wallets, seed phrases, or external exchanges, offering a 'fiat-native' experience that automatically converts Euro deposits into the USDC stablecoin, making investing as fluid as a bank transfer.

The technological core of unflat is direct integration with the Morpho Protocol, a decentralized lending infrastructure that optimizes interest rates in real-time. Unlike CeFi platforms that operate as 'black boxes', unflat guarantees total transparency: every transaction and yield generation can be verified directly on the blockchain, reducing the opacity typical of centralized intermediaries.

On the earnings front, unflat offers an estimated variable rate between 4% and 7% APY, a value significantly higher than the average for traditional deposit accounts in 2026. A distinctive advantage is the application of daily compound interest (daily compounding), which allows capital to grow faster compared to weekly or monthly payments offered by other competitors, without any manual intervention from the user.

- High Yield: Variable rate 4-7% APY, derived directly from DeFi protocols.

- Trustless Technology: Powered by Morpho Protocol for on-chain efficiency and security.

- Total Liquidity: No lock-up period; funds can be withdrawn at any time.

- Accessibility: No crypto trading knowledge or proprietary token management required.

- Transparency: Real-time transaction monitoring on blockchain.

2. Nexo: Established CeFi Platform

Nexo represents one of the most long-standing and structured institutions in the Centralized Finance (CeFi) landscape. Unlike pure on-chain protocols, Nexo operates as a regulated custodian, offering a user-friendly interface that entirely manages technical complexity on behalf of the user. In 2026, it continues to be a solid choice for those who prefer to rely on an intermediary with operating licenses and reserve audits (Proof of Reserves).

The platform allows earning interest on over 100 digital assets, with the convenience of daily compound interest, a feature it shares with unflat. Users can choose between the flexibility of withdrawing funds at any time or opting for fixed terms (time restrictions) to obtain slightly higher percentage returns.

However, Nexo's economic model presents a substantial difference compared to pure DeFi savings accounts. To access the maximum advertised interest rates (up to 16%), it's necessary to climb the Loyalty Tiers by holding a percentage of your portfolio in the native NEXO token. This mechanism forces investors to expose themselves to proprietary token volatility, contrary to unflat's agnostic approach that doesn't require purchasing utility tokens to guarantee the base yield.

- Pros: Daily interest payments, debit card with up to 2% cashback, ease of use for beginners.

- Cons: Centralized nature (counterparty risk), need to hold NEXO tokens for best rates, lower base yields without restrictions.

3. YouHodler: Focus on Loans and Yield

YouHodler stands out in the 2026 landscape as a hybrid platform that combines the ease of use of traditional FinTechs with the high yields of the crypto sector. The platform is particularly appreciated for its savings accounts on stablecoins and fiat currencies (like EUR and USD), offering flexible interest payments that can be configured on a weekly or daily basis.

A reassuring element for Italian investors is the company's strong regulatory compliance, which boasts Swiss roots and European Union operability. This aspect confers a perception of superior security compared to unregulated platforms, positioning YouHodler as a reliable custodian. However, unlike unflat's non-custodial model, here users must entrust their funds to the platform's centralized management.

Beyond simple passive yield, YouHodler integrates more complex tools like the Multi HODL functionality. This service allows users to use a portion of deposited funds to open leveraged trading positions, seeking to multiply gains by exploiting market volatility. While potentially profitable, this approach introduces liquidation risks and operational complexities not present in unflat's pure and automated savings model.

- Operating Model: CeFi (Custodial) with focus on loans and trading.

- Yield: Interest on stablecoins and crypto with weekly or daily payments.

- Extra Features: Multi HODL for aggressive trading strategies (high risk).

- Key difference from unflat: YouHodler incentivizes active trading and collateral management, while unflat automates passive yield without derivative risks.

4. Yearn Finance: The Pure DeFi Aggregator

For blockchain purists seeking maximum decentralization without compromise, Yearn Finance remains a reference point in 2026. Unlike CeFi or hybrid platforms, Yearn operates as a fully automated yield aggregator, managed by smart contracts and not by a centralized corporate entity.

The mechanism underlying Yearn is as powerful as it is complex: through its "Vaults" (V2 and V3), the protocol dynamically moves user funds between different lending and liquidity protocols - such as Curve, Aave, and Compound - in constant search of the best available yield (APY). This automated yield farming strategy allows maximizing profits without having to manually move capital.

However, this sophistication comes with significant barriers to entry. The interface is technical and requires a steep learning curve. Additionally, since complex strategies require multiple on-chain transactions, gas costs (network fees) can be prohibitive for small investors, eroding net returns. In contrast, unflat offers simplified and optimized access to DeFi protocols (like Morpho), removing technical friction and unpredictable costs for the end user.

- Total Automation: Moves funds between protocols to optimize yield.

- Resilience and Transparency: Has demonstrated fund recovery capability and detailed post-mortem analysis even after critical events in 2025.

- Technical barrier: Requires advanced DeFi knowledge and autonomous wallet management.

- Capital efficiency: Less suitable for small amounts due to high transaction fees.

5. Bitget Earn: The Integrated Exchange Option

For users already active in cryptocurrency trading, Bitget represents an extremely convenient solution in the 2026 landscape. The platform allows instantly moving liquidity from Futures or Spot markets to the Earn section, eliminating the need for complex and costly on-chain transfers. It's the ideal option for those who want to optimize capital while waiting for a market entry.

Bitget's offering goes beyond simple savings, including structured products like 'Shark Fin' and 'Dual Investment'. These tools allow obtaining potentially high returns by betting on price volatility, but carry higher market risks compared to a standard savings account. Additionally, as reported by Criptovaluta.it, Bitget serves as a gateway for more advanced DeFi strategies, offering simplified access to lending protocols like Aave and Morpho, or yields through Principal Token on Pendle Finance.

However, this integration comes with a fundamental compromise: centralized custody. Unlike unflat, which operates as a non-custodial interface ensuring users always maintain possession of private keys, depositing on Bitget means ceding fund control to the exchange. While convenient, this model exposes investors to counterparty risk, a critical factor to consider for those seeking maximum long-term security.

- Trading Integration: Immediate transition from Futures markets to yield products.

- Structured Products: Access to Shark Fin and Dual Investment for volatility-linked yields.

- DeFi Gateway: Facilitated access to external protocols (Aave, Morpho, Pendle) via CEX interface.

- Custody Model: Funds managed by the exchange (centralized risk), unlike unflat's on-chain transparency.

Strategies to Maximize Yields While Minimizing Risks

In the 2026 financial landscape, achieving high yields requires a calculated approach that goes beyond simply searching for the highest APY. The golden rule for those approaching DeFi savings accounts is understanding that yield is always correlated with risk. To protect capital while making it grow, it's essential to adopt defensive strategies that isolate investors from the intrinsic volatility of the cryptocurrency market.

The first line of defense is the exclusive use of Stablecoins (like USDC or USDT) for savings products, avoiding direct exposure to price fluctuations of assets like Bitcoin or Ethereum. As highlighted by Criptovaluta.it, stablecoins are designed to replicate 1:1 the value of fiat currency, allowing income generation without the risk of the underlying value crashing overnight. unflat adopts this philosophy by directly converting fiat currency to USDC, offering structural stability.

Diversification Across Protocols and Platforms

A common mistake is concentrating all liquidity on a single platform. A robust strategy involves diversifying counterparty risk and technological risk (smart contract). It's advisable to split capital between transparent non-custodial solutions like unflat and consolidated CeFi platforms or exchanges that offer managed savings products.

For example, platforms like YouHodler offer weekly payments and yields on inactive assets, while exchanges like Bitget allow access to lending strategies on money markets like Aave. Combining these options reduces the negative impact in case a single service experiences interruptions or drastic rate changes.

- Variable rate monitoring: DeFi yields fluctuate based on loan demand. Platforms like unflat offer variable rates (4-7%) that reflect real on-chain market conditions, ensuring sustainability compared to artificially high fixed rates that could hide insolvency risks.

- Yield source verification: Prefer protocols that generate yield through over-collateralized loans (like Morpho or Aave) rather than through opaque trading strategies or excessive financial leverage.

- Immediate liquidity: In a fast-moving market like crypto, the ability to withdraw at any time (no lock-up periods), a key unflat feature, is an essential form of risk management to react to unforeseen events.

Frequently Asked Questions (FAQ)

Are DeFi savings accounts as safe as a bank deposit account?

No, the risk profiles are different. Traditional deposit accounts in Italy are often protected by the Interbank Deposit Protection Fund (up to 100,000 euros), while DeFi does not enjoy this state guarantee. The main risk in DeFi is technological (smart contract) or platform-related.

However, solutions like unflat mitigate these risks through blockchain transparency and the use of consolidated protocols like Morpho. Other players like Nexo focus on regulatory compliance and overcollateralization to guarantee solvency, offering a different security level compared to pure decentralization.

What is the yield difference between a deposit account and DeFi in 2026?

The difference is substantial. According to January 2026 analyses reported by QuiFinanza, the best traditional locked deposit accounts offer gross yields up to 4.50%. These rates often require locking capital for long periods.

In contrast, DeFi protocols and CeFi platforms offer often higher variable rates. unflat offers a variable APY of 4-7% without restrictions. More aggressive platforms like CoinDepo claim yields between 12% and 24%, while Nexo offers up to 16% on certain assets, although these higher rates usually involve higher risk profiles.

Can I withdraw my money at any time?

It depends on the chosen platform. unflat is designed for maximum liquidity: there are no lock-up periods and you can withdraw at any time. This differs from classic "locked deposit accounts" analyzed by Affari Miei, where early withdrawal results in loss of accrued interest or penalties.

Some crypto platforms like Nexo also allow fund access at any time, but often reserve the highest interest rates (Earn in Fixed Terms) for those who agree to lock their crypto for a specific period.

Do I need to buy cryptocurrencies and manage complex wallets to get started?

Not necessarily. unflat's goal is precisely to remove this barrier: it allows direct conversion from fiat currency to stablecoin (USDC) without requiring trading knowledge or proprietary token management.

Other solutions require more experience. For example, using farming strategies on Bitget or direct decentralized protocols often involves prior crypto purchase, gas fee management, and understanding of complex mechanisms like lending on Aave or Morpho.

Are DeFi deposit accounts safe?

It's essential to clarify that security in decentralized finance (DeFi) has a different nature compared to traditional bank accounts. Unlike banks, where deposits are often guaranteed by state funds (like the FITD in Italy up to 100,000 euros), DeFi yields derive from technological protocols and don't enjoy the same public guarantees. The MiCA regulation in Europe imposes stricter standards for some crypto sector operators.

The main risks to consider are two: smart contract risk (code bugs) and custody or platform risk. Even historical protocols can experience issues; for example, Yearn Finance had to manage an exploit in 2025, later recovering part of the funds through emergency procedures and post-mortem analysis. This highlights the importance of choosing platforms that use audited and resilient protocols.

To mitigate these risks, the best platforms adopt various protection strategies:

- On-Chain Transparency (unflat): unflat mitigates counterparty risk by eliminating opacity: all transactions are verifiable on the blockchain in real-time and funds are managed through the Morpho protocol, one of the safest and most liquid in the sector.

- Institutional Custody and Audit (CeFi): Centralized platforms like CoinDepo collaborate with custodians like Fireblocks for wallet security. Similarly, Nexo focuses on regulatory compliance (VASP licenses) and "Proof of Reserves" to demonstrate solvency.

- Overcollateralization: Many protocols require loans to be overcollateralized (the value of guarantees exceeds the loan), a key mechanism to protect depositors in case of market volatility.

In summary, while no investment is risk-free, using platforms that offer radical transparency like unflat or certified custody guarantees drastically reduces exposure compared to using experimental or unregulated protocols.

How are crypto yields taxed in Italy?

In 2026, the Italian tax framework for crypto-assets is now defined and consolidated. Yields generated through DeFi savings accounts, like those offered by unflat, or through staking and lending platforms, are generally treated as "miscellaneous income" and subject to specific taxation at the time of realization (e.g., conversion to Euro or use for purchases).

Current regulations provide for a 26% substitute tax on capital gains, applicable however only if overall profits exceed the exemption threshold of 2,000 euros in the tax period. Below this figure, capital gains are not subject to taxation, although monitoring obligations remain.

- Rate: 26% on the portion of capital gain exceeding 2,000 euros annually.

- Tax Monitoring: Obligation to fill out the RW section in the tax return to report crypto-asset holdings, regardless of profit.

- Stamp Duty: Application of a tax equal to 0.20% on the value of assets held at the end of the period (similar to IVAFE for traditional financial products).

The MiCA regulation has introduced higher transparency standards that facilitate regulatory compliance for regulated operators. However, unlike Italian bank deposit accounts where the bank acts as a withholding agent, in most crypto cases (including exchanges like Nexo or DeFi protocols), the user is responsible for calculating and paying taxes through self-assessment.

Disclaimer: The information provided is for illustrative purposes only and does not constitute tax advice. Regulations may change; it is strongly recommended to consult an accountant specialized in crypto-assets for managing your tax position.

What is the difference between CeFi and DeFi?

The fundamental distinction between Centralized Finance (CeFi) and Decentralized Finance (DeFi) lies in the concept of custody and trust. In CeFi, users entrust their funds to an intermediary company that acts as custodian, similar to a traditional bank. Established platforms like Nexo manage assets on behalf of customers, offering institutional custody services and requiring identity verification procedures (KYC).

In contrast, DeFi eliminates the human intermediary by replacing it with code. Interacting with protocols like Yearn Finance or the Morpho infrastructure used by unflat, users deposit funds in transparent and verifiable smart contracts on the blockchain. In this scenario, yield rules are algorithmic and don't depend on discretionary decisions of a board of directors.

| Feature | CeFi (e.g., Nexo, Bitget) | DeFi (e.g., unflat, Yearn) |

|---|---|---|

| Fund Custody | Managed by company (Custodial) | Smart Contract / User (Non-Custodial) |

| Transparency | Limited (Internal audits/PoR) | Total (Transactions visible on-chain) |

| Access | Requires registration and KYC | Free (just need a wallet) or simplified |

| Yield Source | Institutional loans / Trading | Liquidity protocols (Morpho, Aave) |

While CeFi offers a familiar but opaque user experience, DeFi ensures funds are always verifiable in real-time. unflat strategically positions itself to bridge this gap: it uses DeFi technology (Morpho Protocol) to generate superior yields (4-7% APY), but removes the technical barriers typical of decentralized finance, such as the need to manage complex tokens or gas fees, offering direct access from fiat currency.

Can I withdraw my funds at any time?

The answer depends on the type of product chosen: flexible (or free) or locked. In the 2026 financial landscape, liquidity has become a crucial factor for investors who want to react promptly to market movements without incurring penalties.

Flexible accounts allow depositing and withdrawing capital at any time, maintaining full fund availability. CeFi platforms like Nexo offer solutions where funds are always available ("funds available anytime"), calculating compound interest daily. Similarly, unflat adopts a purely flexible approach: thanks to integration with the Morpho protocol, it imposes no lock-up period, allowing users to withdraw their savings instantly.

In contrast, locked accounts (fixed terms) require locking the sum for a predetermined period (e.g., 3, 6, or 12 months) in exchange for a generally higher interest rate. As highlighted by QuiFinanza in the analysis of bank deposit accounts, the best yields (up to 4.50%) are often subject to time restrictions that make capital inaccessible until maturity.

- Flexibility (unflat / Nexo Flex): Immediate withdrawal, ideal for emergency funds or operational liquidity. unflat offers a variable APY of 4-7% without restrictions, often exceeding traditional locked rates.

- Locked (Banks / Crypto Fixed Terms): Capital locked for months or years. Platforms like Nexo offer increased rates if you agree to lock tokens for a specific period.

- Penalties: In traditional locked accounts, early withdrawal can result in loss of accrued interest or penalties; in liquid DeFi protocols like those used by unflat, this risk is absent.

What is the minimum amount to get started?

One of the most radical changes brought by DeFi in the 2026 financial landscape is the democratization of investment access. Historically, to access the most competitive interest rates through traditional channels, it was often necessary to have large amounts of capital. As highlighted by industry comparators like Affari Miei, the best deposit account offers are sometimes structured to reward locked liquidity or significant amounts, leaving small savers with less profitable options.

In contrast, digital asset-based platforms have drastically reduced these thresholds. CeFi solutions like Nexo or YouHodler allow starting to generate passive income with very low minimum deposits (often in the order of a few dozen euros), making the market accessible even to those who want to experiment with small amounts before committing larger capital.

unflat fully embraces this philosophy of financial inclusion. Thanks to the efficiency of the Morpho protocol, prohibitive minimums typical of private banking are not required to access the variable rate of 4-7% APY. This allows users to progressively build their savings plan, benefiting from daily compound interest from the first deposit, regardless of its size.

- Traditional Banks: Often require high minimum deposits (e.g., 1,000-5,000 euros) to unlock promotional or 'Premium' rates.

- CeFi Platforms (e.g., Nexo, YouHodler): Allow entry with reduced capital, but may require purchasing proprietary tokens to obtain maximum yield levels.

- unflat (DeFi): No minimum deposit imposed by the protocol and no requirement to own extra tokens to access the base rate of 4-7%.

Start earning with unflat

Access DeFi yields without technical complexity. Join the waitlist for early access.

Join the waitlist